What do actuaries really want? Career satisfaction and development needs

Whether we become Fellows or Associates, we actuaries literally spend years studying. But what happens once we finally reach the end of our formal actuarial studies? Do we think it was worth it? Do we have all the skills we need to build a great actuarial career? Or do we find ourselves looking for more?

I work with a lot of actuaries helping them build their careers, most commonly after they have finished their actuarial studies. One theme that has been coming up recently is career decisions and regrets. One actuary even told me they regretted becoming an actuary altogether!

To explore these themes further, Ryan Boyd, Matt Webster and I asked the membership what they really want in our survey “What do actuaries really want?”. While our key findings are outlined in our Summit presentation, this article takes a closer look at the career satisfaction and development needs of actuaries.

So what do real actuaries actually want?

Respondents from our survey were slightly older and more likely to be Fellows, compared with the overall Actuaries Institute membership. As a result, we analysed the results based on membership status and years of experience to make sure the different profile didn’t introduce additional bias the findings.

We asked actuaries:

How satisfied are they with their career choice to become an actuary?

How many practice areas have they worked across?

Are they interested in working in non-traditional roles in the future?

What additional skills do actuaries need, and who should provide them?

What additional support do actuaries need to support their career development?

For ease of reading I have used the term “actuary” throughout this article to refer to all respondents, whether they were students, Associates or Fellows. The results are outlined below.

Are actuaries really satisfied with their career choices?

Overall, 86% of actuaries (including 84% of Fellows) were satisfied with their choice to become an actuary. It is interesting to see that actuaries with more than 25 years of experience were most likely to be “very satisfied” with their career choice, compared with less experienced actuaries.

While making up a minority of respondents, just over half of female actuaries were “very satisfied” with their career choices. 84% of male actuaries were “very satisfied” or “somewhat satisfied” with their choice, but they represented 100% of actuaries who expressed dissatisfaction with their career choices.

Interestingly, all Associates expressed positive satisfaction, and only Fellows and students expressed dissatisfaction with their career choices.

The breakdown of career choice satisfaction for Fellows is shown below:

Do actuaries work in the same practice area across their careers?

While 60% of students have only worked in one practice area, most Associates and Fellows have worked in two or more practice areas across their careers.

The number of practice areas actuaries have worked in throughout their career did not vary significantly between those currently working as consultants and those working for insurers / reinsurers / other corporates, with 28% of both groups having worked in one practice area and the rest having worked across two or more practice areas.

Do all actuaries want to work in non-traditional areas and roles?

There has been much discussion about the importance of actuaries branching out and working outside “traditional” areas of actuarial work. But do all actuaries want to do this?

The survey showed that just over half of Fellows are interested in working in non-traditional roles or fields in the future. However, about a quarter are not interested, and another quarter don’t know!

However, the overwhelming majority of Students (69%) and Associates (91%) said they would like to work in non-traditional roles in the future. The graph below shows appetite for non-traditional work across the age bands, which also suggests that younger actuaries are more likely to aspire to non-traditional roles compared with actuaries over 55, who may be satisfied with their chosen role and field.

What additional skills do actuaries need, and who should provide them?

To ensure our ongoing relevance, it is important to know what skills actuaries need to support their career development. We asked whether actuaries needed additional training from the actuarial education program, the Actuaries Institute and their employer.

Nearly half (49%) of respondents said they would like more soft skills training, including management, communications and negotiation skills to support their careers.

But who should provide this training? The education program, the Actuaries Institute, employers? Here’s what we heard:

55% of respondents called for additional training, particularly around coding, data analytics and modelling, from the actuarial education program. I understand the education program has recently been changed to include more of these subjects, but many Fellows highlighted these additional needs.

69% of respondents wanted more training from their professional body. This included more “in-person” networking across more locations, sharing of case studies and access to mentors. Respondents also wanted more training on ethics, communication, professionalism, management and leadership training and short courses and workshops on a range of professional topics.

61% of respondents wanted more training from their employers, particularly training in management, presentation and communication skills. The word cloud below shows what actuaries want from their employers.

We also asked actuaries to identify whether they need more technical skills, coding or tools training, management skills or presentation skills.

While actuaries could choose more than one of these, the most identified area for further skills development related to management skills.

We asked the actuaries who manage people how confident they feel in their roles as managers. While 96% of people managers feel some degree of confidence, only 51% strongly agree with the statement “I feel confident in my role as a manager”. This suggests that there are a lot of actuarial managers with room to improve their managerial confidence.

A similar pattern was observed when we asked whether managers felt effective, or supported by their companies to develop as managers: about half strongly agreed with these statements and half somewhat agreed with them.

What additional supports do actuaries need to support their career development?

Beyond skills, professionals need a range of supports to help their career development. We asked actuaries to identify whether they need more mentoring, networking, professional sounding boards or opportunities to build broader professional skills to support their career development.

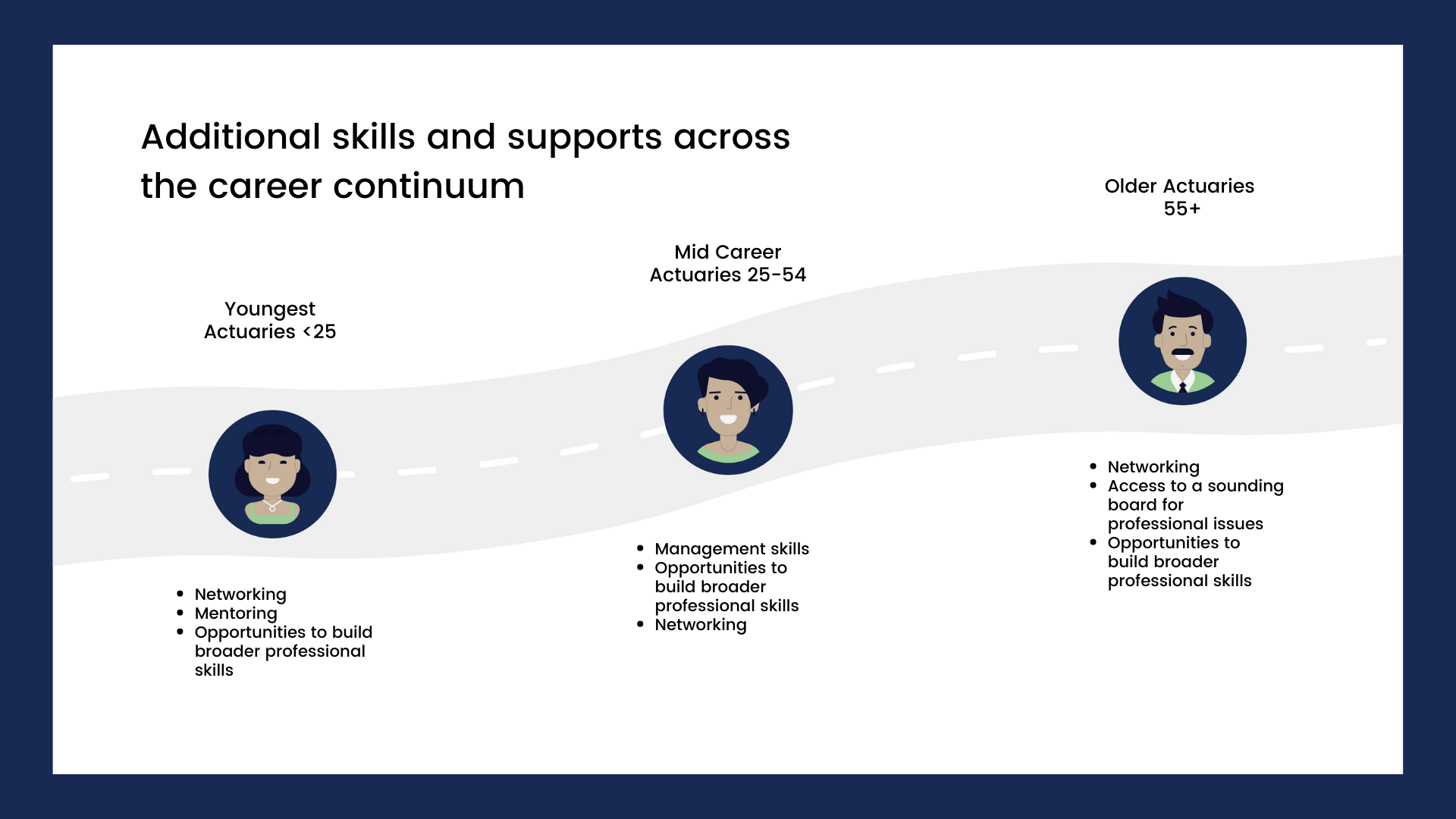

Across both skills and supports, actuaries aged 25 - 54 identified training (management skills and broader professional skills) as what they needed to support their career development. Actuaries under 25 most commonly cited networking and mentoring as most important, while actuaries over 55 identified networking and access to a sounding board as what they most needed to support their career development.

Conclusion

Overall, the majority of survey respondents expressed satisfaction with their decision to become an actuary. In particular, female respondents and Associates were more likely to be satisfied with their choice of an actuarial career.

Actuaries like variety – most Fellows and Associates have worked in at least 2 different practice areas and 61% of respondents said they’d like to work in a non-traditional role in the future. However, almost half of Fellows said they didn’t know, or didn’t want, to work in a non-traditional role in the future, so we must not assume that this is important to all members. Younger actuaries were more keen on the idea of a non-traditional role in future, compared with older actuaries.

Even more important than technical skills or learning how to code, actuaries cite networking, management skills, the opportunity to build broader professional skills and having access to a sounding board for professional issues are important to support their career development.

It appears that there are still gaps in skills and supports needed to help actuaries develop their careers. How will we, as a profession, address these gaps? Is it up to employers, or the Actuaries Institute, or do we need to think differently to ensure our ongoing capability and relevance? What happens if we don’t address these gaps? Will we lose younger members of the profession, or will we have technical practitioners with suboptimal networks and people management skills?