Unlocking Team Brilliance: The Hybrid-Working Magic

This article was originally published on Actuaries Digital on 7 December 2023.

by Alfie Qiang, Amitoze Singh, Vanessa Angelica and Whitlam Zhang

We currently find ourselves in a changing work environment. What does it take to nurture high-performing teams now, and how can we make the most of the diverse talents in our workforce?

The way we work is evolving, moving away from old, rigid methods. In this article, we’ll investigate how the flexibility of a hybrid work model can help us tap into our diverse workforce’s potential and create highly effective teams.

One might assume that working together in a traditional office setting is helpful in achieving high performance due to physical proximity and constant interaction. However, the reality is that different people’s lives and needs can be far from fitting into a rigid nine-to-five structure, with 83% of global workers viewing a “hybrid model as ideal”[1]. Let’s explore how a diverse team of four individuals below, can combine their unique working styles and personal lives to function cohesively as a high-performing team.

Moira, a recent actuarial graduate;

David, the manager of Moria, with a 7-year-old child;

Johnny, a night owl, works closely with the London team; and

Alexis, a new mom with a partner working full-time.

The infographic below provides snapshots of their daily routines and interactions, showcasing their ability to contribute positively despite their diverse lifestyles and preferences.

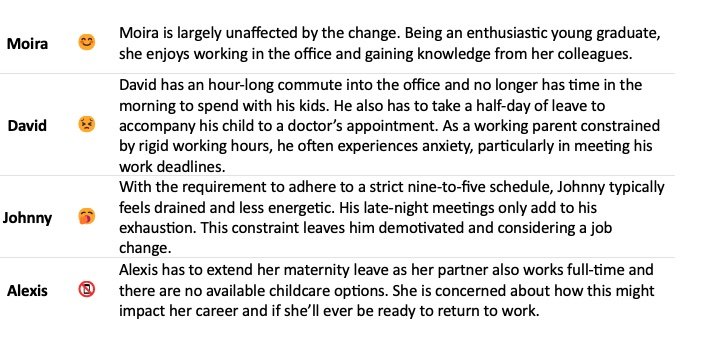

What if they were to return to the conventional nine-to-five office model? Did it prove effective in the past, and are there any drawbacks to it? Let’s take another look at our four colleagues and examine the implications of reverting back to such a model.

While there may be some benefits, especially for early career actuaries, our illustrative case study suggests that reverting to the traditional working model would, on the whole, negatively affect both team performance and morale. It could lead to colleagues not working at their full potential, or even not working at all, and elevating the risk of burnout, potentially resulting in team disruptions and staff turnover. Recent findings indicate that workers who do not feel supported in their work location are up to 7.7x more likely to leave their organisations.[1]

Moreover, not implementing a hybrid work model can result not only in the loss of valuable talent but also pose challenges in recruiting new employees. Studies have highlighted that the absence of flexibility in work arrangements acts as a decisive factor for job seekers when choosing an employer. 43% of Australian workers view non-flexible arrangements as a deal-breaker in finding a job.[2]

Therefore, embracing a hybrid approach to work, which offers flexibility while embracing the diversity within our workforce, can help to address the issues that can get in the way of high-performing teams. We encourage actuaries to be daring in their thinking and discard outdated norms from the past. This shift toward hybrid working models not only respects the diversity of the workforce but also sets a solid foundation for creating high-performing teams that excel in the dynamic modern work environment.

References

[1] (2021/2022). Future of Work Research. Retrieved from https://www.accenture.com/us-en/insights/consulting/future-work

[2] The Centre for the New Workforce, Swinburne University of Technology. (2021). Hybrid Working in Australia. Retrieved from https://www.swinburne.edu.au/research/centres-groups-clinics/centre-for-the-new-workforce/our-research/hybrid-working-australia/

Authors

Alfie Qiang

Alfie is a senior consultant with WTW’s Insurance Consulting and Technology practice, based in Australia. With more than eight years of experience in the Life insurance industry, she has worked in consulting and pricing roles both in Australia and internationally. Her expertise lies in actuarial pricing, product development, valuation, and playing a strategic advisor role in facilitating business decision-making.

Amitoze Singh

Amitoze is a Corporate Actuary at Pacific Life Re where he has experience across both the Pricing and Valuation teams. Amitoze is passionate about bringing forward fresh ideas and techniques to address current and emerging issues across both the business and the industry.

Vanessa Angelica

Vanessa is an R&D Actuary at Pacific Life Re, where she works on creating innovative solutions for the life insurance industry. She has experience in both valuation and R&D, and has developed skills in actuarial modelling, product development, and data analysis. She enjoys applying her analytical and creative abilities to solve complex problems and add value to the business.

Whitlam Zhang

Whitlam is currently Head of Strategic Research at Future Group. Whitlam leads a team responsible for providing strategic advice to the firm’s Investment Committee and Trustees. Prior to joining Future Group in 2022, Whitlam was Vice President of Research & Strategy at Morgan Stanley. Prior to Morgan Stanley, Whitlam was a portfolio manager at Tibra Capital and a senior analyst at Russell Investments.